How Much Money Will I Get From Warren

21 Life Hacks From Warren Buffett That Anyone Can Use

Warren Buffett's advice is expert for both business organization situations and personal ones.

1. Decide That You're Going To Be Rich

In lodge to be rich, y'all take to believe that one day yous will be. According to the Huffington Post, Buffett once reportedly said, "I ever knew I was going to be rich. I don't think I ever doubted it for a minute."

For best results, ready high expectations for yourself and work toward your goals and aspirations.

"And so, go far clear to yourself, your family and friends that you lot accept a commitment to get financially independent," said Randall "Dolph" Janis, an insurance amanuensis at Clear Income Strategies Group. "Create your future with a programme, knowing when to get ambitious against knowing when to exist conservative."

two. Showtime Saving at a Young Historic period

Past historic period 15, Warren Buffett had earned $2,000 delivering papers and selling magazine subscriptions, according to CNBC. He used $1,200 of his earnings to invest in a farm, forming a turn a profit-sharing understanding with the farmer.

The lesson? "Start saving money as early as possible, and then that y'all get into the habit," said Brittney Castro, founder and CEO of Financially Wise Women.

This is important whether you're saving to invest in a business or buy your commencement house.

3. Reinvest Your Profits

When Buffett was in high school, he and a friend bought a pinball machine. Co-ordinate to Biography, the pair put it in a barbershop and quickly earned enough to purchase more than machines and install them in other shops. The friends eventually sold all the machines for a profit of $1,200.

If you want your fortune to grow, the best thing yous can practise is keep reinvesting it in your concern. Of course, you tin can enjoy the fruits of your labor, but don't spend it all in i place.

4. Graduate College Early

Because of Buffett's sharp mind for business, it'southward no surprise that he managed to stop higher in three years — two at the Wharton School of Business and one at the University of Nebraska, co-ordinate to the book "Icons of Business organization." Although college costs weren't nearly as high in Buffett's day every bit they are today, it's likely that he saved money past completing his pedagogy in three years instead of 4.

Today'southward college students can save by following his pb.

For the 2016-2017 schoolhouse year, the College Board estimated that the average cost of tuition at a individual higher was $33,480. If you attended a state schoolhouse as a resident, you spent $9,650 per year. However, graduating early could salvage you lot even more when you factor in the cost of student loan interest paid out over the adjacent 25 years.

five. Bounce Back From Rejection

Ironically, Harvard Business concern School rejected Buffett afterward his interview. But instead of sulking, he headed to Columbia and met Benjamin Graham. Graham is a legend in the investment industry, and he became Buffett's mentor. Much of Buffett'southward incredible investing success could arguably exist credited to Graham and the lessons he taught him.

"Turned downwards? Who cares, keep going, it happens all the time," said Tom Scuccimarra, national sales manager at Thou&O Marketing. "Y'all can't accept information technology personally, and you tin can't permit it push button yous off course of your dreams."

Even if you get rejected from a schoolhouse or chore opportunity, it'southward important to keep moving forward. If Buffett had quit after Harvard dismissed him, he wouldn't be where he is today.

6. Communicate in Person

In 1951, when Buffett was looking for companies to invest in, he stumbled across GEICO. To investigate farther, he rode a railroad train to the company'south headquarters. According to GEICO'south website, the part was airtight, so a janitor let him in. Luckily, a superlative executive was there, and they had a coming together. After, Buffett made ane of his primeval stock purchases invested in GEICO. Today, the insurance visitor is a subsidiary wholly owned by Berkshire Hathaway.

Follow Buffett'southward communication and don't underestimate the value of face up-to-face communication. When you're trying to attain a business or personal goal, sometimes a phone call or email just won't cut it.

seven. Be Persistent

When Buffett graduated college, he wanted to work on Wall Street. He offered to work for his mentor Graham, but Graham said, "no," wrote author James Altucher on his website. So, Buffett went dorsum to Omaha — only he even so connected to pitch ideas to Graham. Eventually, Graham hired Buffett.

If y'all become a "no" from a potential employer who you really want to piece of work for, never accept information technology equally a final answer — keep trying until you get a "yes."

8. Master Public Speaking

Expert public speaking skills can take you far in your profession. However, speaking in front of large groups tin be terrifying for some — even Buffett. In fact, Buffett admitted that used to throw up before public speaking.

But instead of letting his fear cripple him, Buffett took the necessary steps to improve his public speaking skills. According to Forbes, he took a Dale Carnegie public speaking course and he learned that he could, in fact, speak in front of a group. Buffett went on to become an fantabulous orator.

9. Maintain Good Savings Habits

According to the volume "Icons of Business," Buffett returned to Omaha when Graham airtight his partnership. Luckily, he had his finances in order. By being a good saver and avoiding debt, Buffett grew his savings from $9,800 to $140,000. He then went on to create Buffett Associates, Ltd.

Paul Tarins, president and founder of Sovereign Retirement Solutions, said, "When evaluating your greenbacks catamenia, yous should understand that the more revolving debt you acquit, the more you volition diminish the amount that can be invested."

Past saving money and avoiding debt, you too tin have advantage of business concern opportunities and pursue personal goals, such as retiring early.

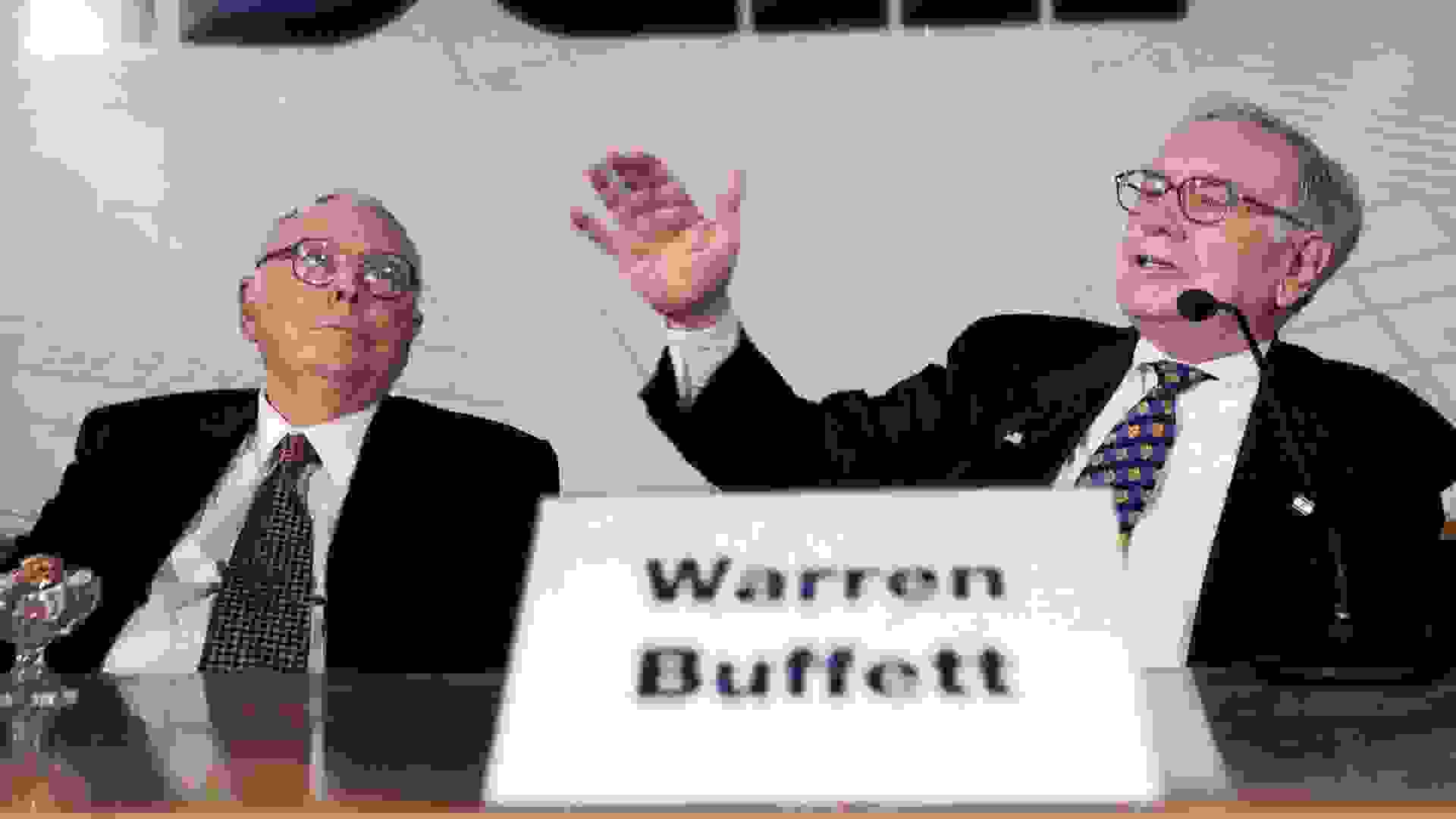

10. Find a Business Partner

One could fence that Buffett wouldn't be successful without Charlie Munger, his billionaire correct-hand human. Co-ordinate to the Economist, the pair met in 1959, and today Munger is the vice chairman of Berkshire Hathaway.

Business Insider reported that Buffett once wrote, "It took a powerful force to move me on from Graham's limiting views. It was the power of Charlie's mind. He expanded my horizons." Together, they took on some of Buffett'south largest acquisitions, such every bit BNSF Corp.

If y'all want to be successful, information technology's important to find a trusted partner — be it a business acquaintance, friend or spouse — who challenges you to be meliorate.

xi. Exist True to Yourself

Berkshire Hathaway is located in a adequately average-looking building in Omaha. Only since Buffett is worth close to $75 billion, many assume he works in more than luxurious digs.

"Your personal paradigm is not the perception of how successful you are. Don't be someone you are not," said Janis. Buffett owns who he is — a humble, grounded and notoriously frugal man. Flashy headquarters wouldn't accommodate him.

You can follow this life hack past owning who you are; the people around you will view you as more authentic equally a effect.

12. Live Frugally

Whatever your goals are in life, living frugally gives yous the breadth to accomplish them. Dissimilar other billionaires who alive lavish lifestyles, Buffett is known for living modestly.

In fact, Munger said during the 2014 Berkshire Hathaway Annual Q&A, "Frugality is basically how Berkshire happened."

"There are things money can't buy," Buffett said at the aforementioned upshot. "I don't call up standard of living equates with cost of living beyond a certain point. Good housing, adept health, expert nutrient, skilful transport. There'due south a point you start getting inverse correlation between wealth and quality of life. My life couldn't be happier. In fact, it'd be worse if I had six or eight houses."

13. Invest In Yourself

Part of Berkshire Hathaway's success is due to the fact that Buffett put his money where his mouth was and invested in himself. Tarins believes that'south imperative if you want to succeed in business organisation and life.

"The best way to accomplish wealth is e'er to pay yourself first," he said. "Many people are currently doing this by investing through their visitor'south retirement plan. If you develop the habit of e'er paying yourself offset, you will be extremely successful in acquiring wealth."

fourteen. Stick to Your Guns

Berkshire Hathaway does not pay dividends. In fact, it paid out its only dividend in 1967, co-ordinate to Investopedia. And Buffett claimed that he must have been in the bath when this happened.

Buffett reportedly doesn't similar dividends, partly because they are taxed equally income. Not receiving a dividend from Berkshire Hathaway is probably a sore spot for many investors. Regardless, Buffett refuses to pay them.

Sticking to your guns is a skillful life hack whether you're talking about investing in a business venture or allowing your teenager to go to that unsupervised party.

15. Be a Contrarian Investor

Buffett is what yous would phone call a contrarian investor — meaning he's known for buying assets that aren't doing well and so selling them when they practice perform. Equally he in one case wrote for the New York Times, "Be fearful when others are greedy, and be greedy when others are fearful."

Existence a contrarian or a value investor in life can take you far. Mitch Goldberg, president of investment firm ClientFirst Strategy, explained in a piece for CNBC that existence a contrarian "requires identifying a visitor that will execute a program to grow the business organisation and at the same time has decent fundamentals … and then that if the programme takes longer to execute or if it doesn't work, you'll at least potentially have something of value that y'all could sell at a later on appointment."

You can follow this communication past existence careful about where y'all spend your money and avoiding fads.

sixteen. Don't Invest Emotionally

Many investors have the urge to sell stocks when the market is down. However, a popular piece of Warren Buffett communication is to put your emotions bated when making business organisation decisions.

Reminding investors to keep their emotions in check, Buffett told Forbes, "Y'all're dealing with a lot of silly people in the marketplace; it's like a slap-up large casino and anybody else is boozing. If you can stick with Pepsi, you should exist okay."

For best results in business organisation and life, follow this Buffett tip and avoid making crucial decisions in the oestrus of the moment.

17. Make the Tough Calls

Berkshire Hathaway'south core business organisation was originally material mills, and Buffett maintained them for many years. In 1985, he sold the factory'southward equipment because they weren't making him any coin. In fact, they were a bleed on his company, according to Business organization Insider.

The decision might have been tough for Buffett to make, only it was imperative to his success. Making the difficult telephone call is of import in life, as well. For example, you lot might have to skip that expensive vacation and invest your extra dollars in a retirement fund, instead.

eighteen. Invest In What You Know

Buffett is famous for property Coca-Cola stock; he purchased a six.3 percent stake in the company in the late 1980s. As of July 18, 2017, he owned an viii.73 percent share in the soft drink company.

Buffett certainly knows Coke well — he drinks up to v cans a solar day, and he one time said, "I'm one quarter Coca-Cola."

You can follow this communication past pursuing a career about which you're truly passionate.

19. Exist Honest

Buffett is known for his honesty. In a Berkshire Hathaway shareholder letter, he admits to losing $873 meg by purchasing Energy Future Holdings' $2 billion debt and calls it a "large mistake."

Honest business practices build trust amidst colleagues, staff and even competitors. Moreover, investors so express confidence by offering more funding. The lesson? Be honest; it'll likely help your business — and your personal life — in the long run. Investing in what you lot know is also easier when you know more than, and y'all tin can increase your noesis by checking out 20 Warren Cafe recommended books.

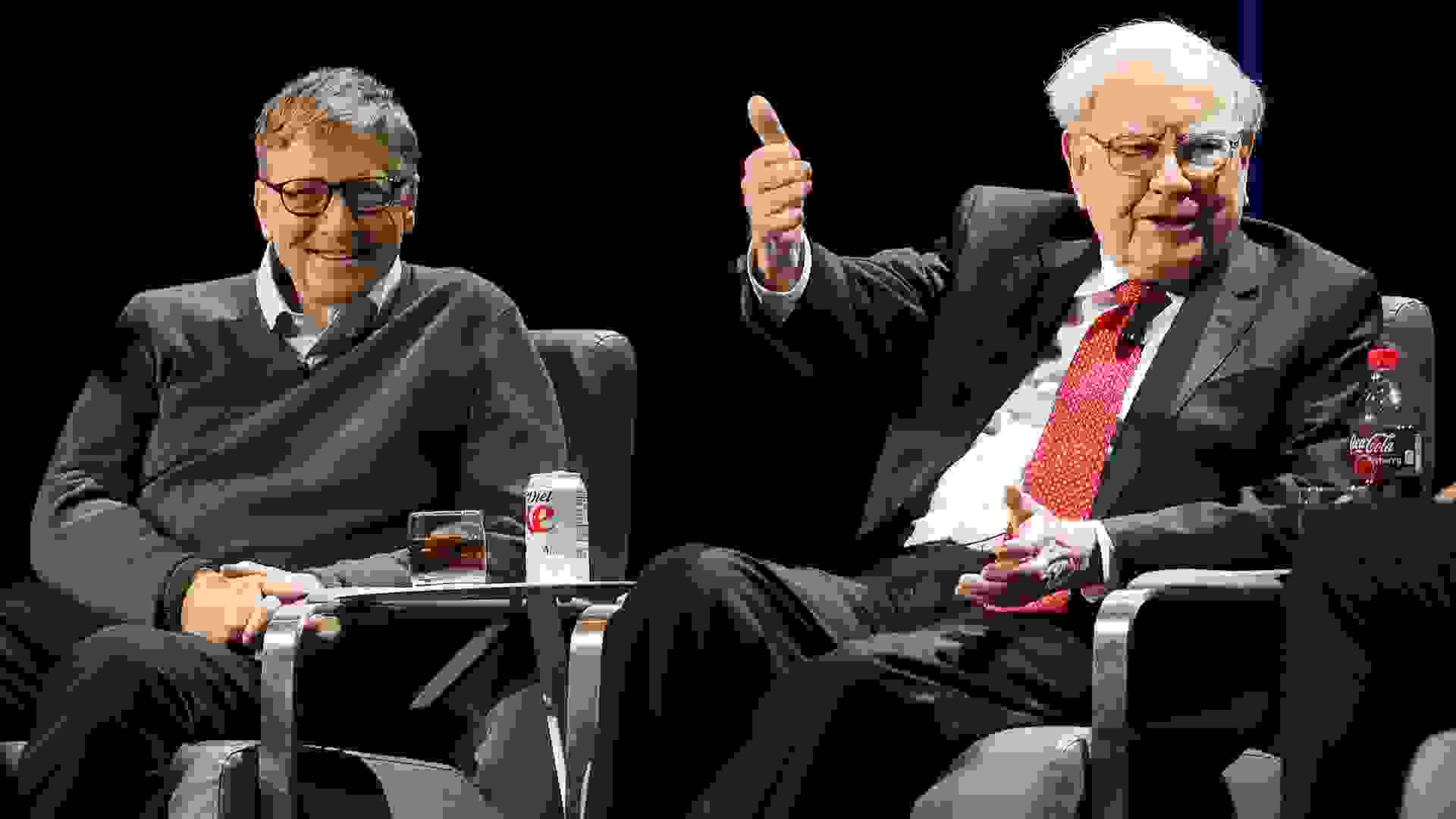

20. Requite Dorsum

As far as philanthropy goes, Buffett is probable one of the almost generous men in the world. And along with Bill Gates, he is donating over half of his wealth. In 2010, Buffett started the Giving Pledge with the Gates family unit, which encourages billionaires to commit to giving abroad a big portion of their coin while they are living or in their wills. Every bit of 2017, 154 billionaires had signed.

However, giving dorsum is important even if you're not a billionaire.

Said Buffett, "If you're in the luckiest 1% of humanity, you owe it to the rest of humanity to recollect about the other 99%."

21. Limit Your Activities

About the Writer

Source: https://www.gobankingrates.com/money/wealth/23-steps-become-next-warren-buffett/

Posted by: dewanste1974.blogspot.com

0 Response to "How Much Money Will I Get From Warren"

Post a Comment